Crypto Celebrity Death Match 🥊

EDITION N°13 | 18 November 2021

If MTV was still doing CDM, they would have to get Sam Bankman-Fried [FTX] & Kris Marszalek [Crypto.com] on for an episode. The two high profile exchanges have been in fierce ‘deep pocket’ competition and this week Crypto.com took the lead with a $700 million naming-rights spend.

It’s been yet another large week in the cryptocurrency ecosystem. From marketing budget showdowns to ecosystem fundraises, fund launches, and… some regulator scrutiny. Can we blame the regulators for their concern/alarm? Not really. They aren’t alone in nervously watching the biggest ever money explosion unfolding. Every major player in the crypto field is [not-so-gradually] ratcheting up the stakes. Are the bells ringing? Yes. Can we hear them? Yes. Are we alarmed yet? ... [crickets]. It’s been a week. Let’s recap.

1. [Celebrity] Exchange Duelling: Round 8

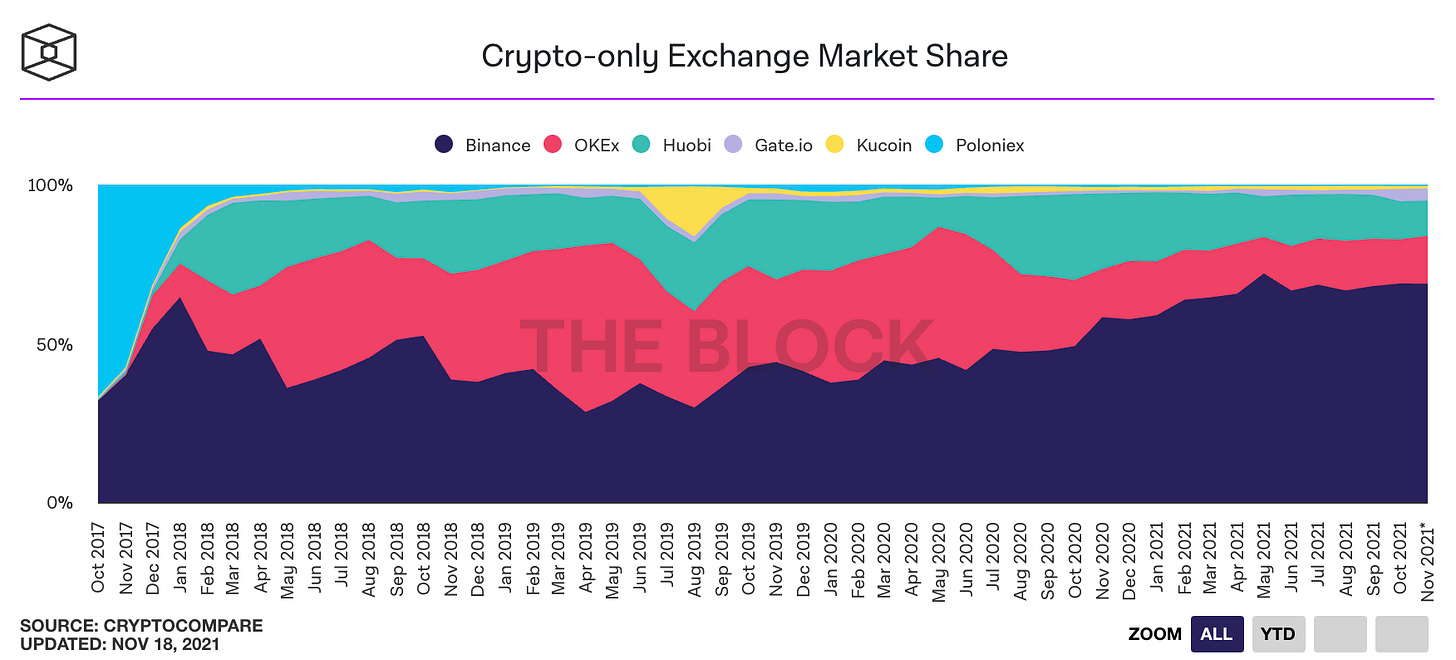

This week witnessed yet another MASSIVE marketing budget blowout, with Crypto.com dropping a casual $700 million on naming rights for the Staples Center, one-upping FTX’s June naming rights investment of TSM. Over the past year, exchanges FTX and Crypto.com have spent $1 billion on sports sponsorships. Interesting that Coinbase and Binance have stayed out of the ring somewhat, considering Binance processes $76 billion of crypto each day [WSJ]. That daily total is more than Binance’s four largest exchange competitors put together. The following chart gives an idea of the size of their dominance in terms of market share.

A cursory glance at the Pew Research Center report released this week, suggests that just 16% of Americans have invested in, traded or used cryptocurrency. So it is understandable why the industry ‘laggards’ are going to such costly lengths to get their names out there; when comparing the total market capitalization of digital assets [$2.55 trillion today] to global equity markets [$105 trillion], there is significant potential for growth.

2. In the crosshairs

‘How deep are your pockets, mate’ could actually be a meme, given how dominant the showdown theme has become in the crypto space. This past week alone, we have seen: Crypto gaming platform Forte raising $725 million, ConsenSys raising $200 million, Gemini [exchange] raising $400 million to build a Metaverse, DCG raising $600m via a credit facility, OpenSea’s new funding round offers to set their valuation at $10 billion and that’s just a handful. The biggest [$] fundraising news this week? Paradigm [VC] announcing a $2.5 billion crypto project investment fund, topping the a16z $2.2 billion fund announced in June this year. [Wiiaaoow].

It’s starting to feel a bit like ‘pick a raise/valuation number’ which renders this article even more poignant. It’s somewhat unsurprising that the regulators are concerned. Michael Hsu, Acting Chief of the OCC this week commented: “The agencies are approaching crypto activities very carefully with a high degree of caution … safety and soundness is paramount”. It’s tricky to decipher what this [somewhat] vague rhetoric actually means for US banks, but with the SEC scrutinizing BlockFi for their high yielding activities, the ECB warnings around stablecoin-driven digital asset volatility, and also Israeli authorities tightening regulations with stricter KYC/AML, fear/uncertainty still lingers in the air. The other knock-on effect is fairly profound, however: the rising clamor for decentralized financial protocols to carry the weight for CeFi institutions. DeFi is a useful integration partner for CeFi activities. The secret sauce is where CeFi exchanges’ native users can take advantage of DeFi infrastructure, functionality and yields under-the-hood.

3. The Spirit of Crypto

We have discussed the notion of ‘white hat’ hackers in the past - the general idea being that smart contract ‘wizards’ will uncover a weakness in a protocol’s code, launch an exploit, syphon-off funds and then return them, prompting a dev scramble to fortify the smart contract security. A couple of weeks ago, The Block published an article suggesting there had been a total of $1.4 billion of funds taken from DeFi protocols, with $740 million returned, leading to a net $680 million stolen.

However, Elliptic’s report fresh-off-the press today would imply that number captured less than 10% of the total exploits, with the dollar value amounting to $10.5 billion year-to-date. It is a vast data analysis undertaking to uncover exact numbers, but the fact of the matter is, DeFi crime is on the up. Nevertheless, in the spirit of OG crypto, ecosystem sheriffs are also doing some policing of their own. Twitter vigilantes are exposing scammers, which isn’t a comprehensively professional solution but is definitely in keeping with some of the OG ethics in the space. The larger conclusion to draw from this knowledge is the same as we drew a couple of weeks ago: DYOR, care and attention are still key. Also [from ed.10]:

“nstitutional [Compliant] DeFi is now a growing market with Aave and Compound both venturing into the market with institution-grade DeFi products. The benefit of a KYC/AML layer in DeFi is that the counterparty-risk is lowered; being part of a known and trusted-counterparty environment is a lot safer for institutions to conduct decentralized financial transactions and one of the reasons why institution-grade DeFi technology providers like Alkemi Network are particularly well-positioned to meet demand as the SEC analyzes the ecosystem, the FDIC prepares guidance for banks and the FATF releases somewhat vague [Valkenburgh] crypto guidance…”

And now, time for some mind-blowing podcast conversation from cryptopreneur OG, Cooper Turley.

Social tokens, the DAO landscape, compensation and how Web3 community projects can develop incentive mechanisms for their Decentralized Autonomous Organizations. If that sentence was bewildering, bamboozling and bizarrely captivating then this is the podcast for you :) Enjoy!

… brought to you by Alkemi Network

Alkemi Network is an institution-grade liquidity network for financial institutions and individuals to access professional DeFi and earn yields on their Ethereum-based digital assets. Access subsidized borrowing rates on the Alkemi Earn platform, use the ‘Verified’ digital asset pool to conduct borrowing and lending within a trusted-counterparty liquidity environment. Be compliant, use Alkemi Network.

We also offer competitive rates, e.g. on Monday, we had 32%+ APY on USDC alone. Check us out, don’t miss out: Alkemi Earn: