Don't Stop Me Now

EDITION N°10 | 28 October 2021

“I’m having such a good time, I'm having a ball.”

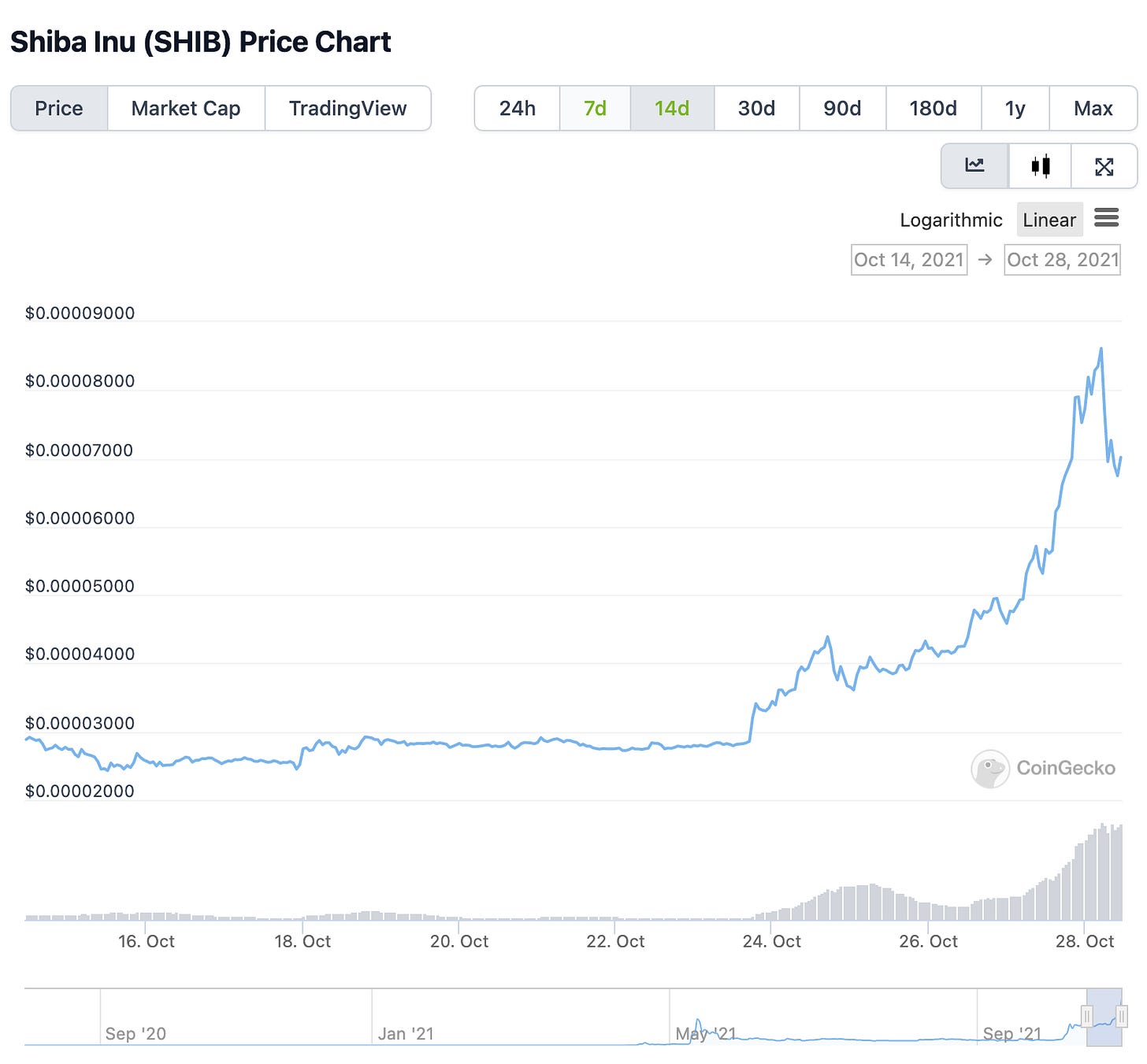

Freddie Mercury sang this song long before the glory days of digital assets, DeFi or NFTs had even begun. However, if Sir Mercury was here today, he would have been singing this anthem alongside the entire Shiba community as their token started to ‘mewn’ this week [i.e. go to the moon 📈]. He may have also sung it with the OG DEX, Uniswap, who just passed $500bn of volume traded since their launch ~3 years ago! However, he may not have been singing it for C.R.E.A.M. [or their adherents] who were exploited for the *third time* yesterday afternoon when a flash loan attack raked $130+ million of assets from their pools.

Every week brings a new set of twists and turns in Digital Asset land but there’s always a slew of new stories to discuss! Are we ready? Let’s goooooo.

1. Shopping list: Marshmallows, pumpkins and Bitcoin.

At least, that’s what you could ‘hypothetically’ buy if you were to go to 200 of Walmart’s stores now. Who would have thought 2021 would be the year you could purchase Bitcoin whilst perusing the aisles for the best Halloween comestibles available to mankind.

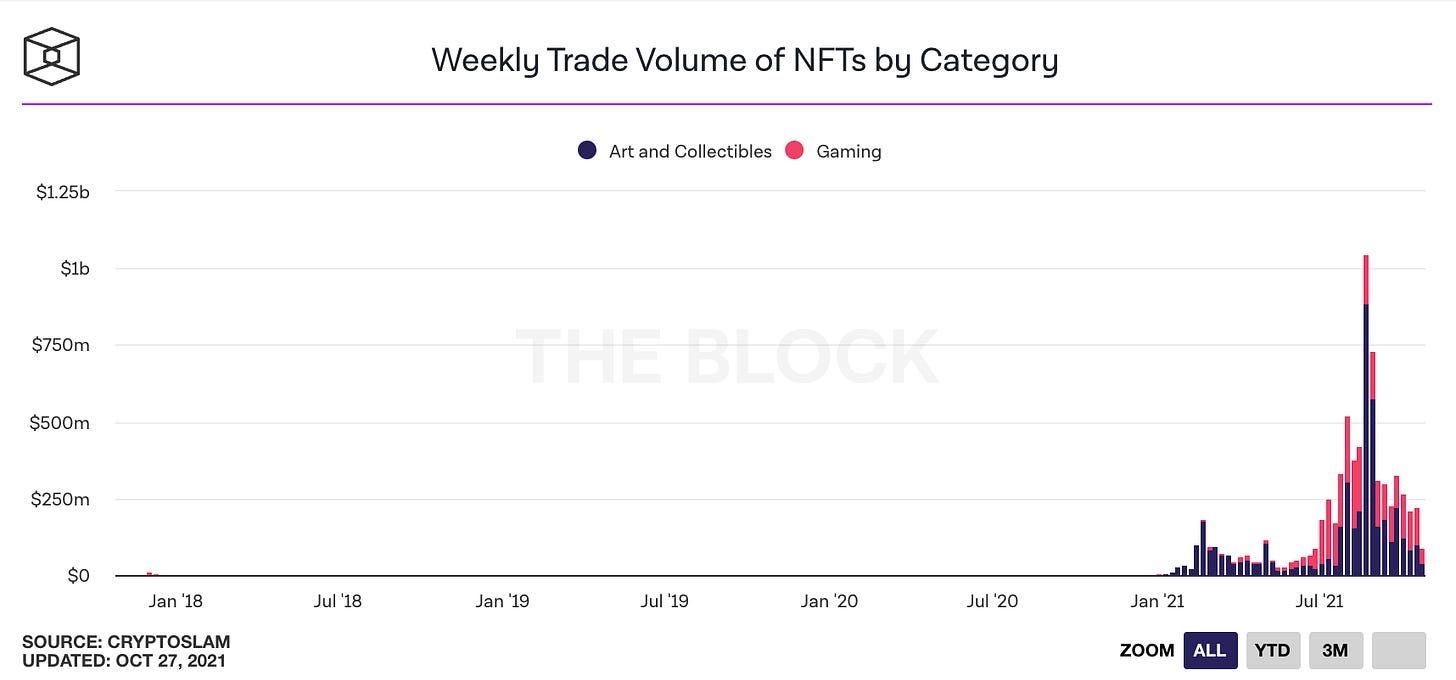

“The times they are a-changin”, the lyric penned by B. Dylan is still so relevant, he just needs to add the word ‘rapidly’. Not only is the supermarket accessibility for $BTC part of the mainstream adoption narrative, it also highlights the curiosity/awareness/demand is there and is rising. The possibilities offered by on-chain activities & digital assets are growing too: whilst the total value of NFTs on Ethereum hit an estimated $13.2bn by the end of September 2021 [DappRadar Industry Report], this is JUST the beginning… Jefferies expect the value of NFTs to approach $80bn by 2025.

Note, the vast majority of NFT price/trade vol growth has taken place since the start of this year. [Early].

As The Economist article above points out, the range of use cases for NFTs stretch further than simply Art & Collectibles [JPEGs] and Gaming; these on-chain registry items carry the potential to unlock utility to a limitless extent, acting as digital keys for their holders to participate in a plethora of on-chain activities. These are not just a flash in the pan. NFT-based games are going to be BIG as Chris Dixon of a16z points out, although a quick glance at Axie Infinity‘s burgeoning ‘Play to Earn’ ecosystem and Loot’s rapid unfurling confirms that fairly succinctly. Web3 is just getting started and that’s the point. What is Web3? The definition here is useful:

“Web 3 is the next step of the Internet … an Internet that is made possible by decentralized networks … that no single entity controls, yet everyone can still trust. … [T]hese networks allow value or money to be transferred between accounts [held by network participants]”

The next 10 years are going to be exciting in terms of technological and coordination opportunities. Are we currently in an NFT bubble? Maybe. Is housing in a bubble though? Perhaps. But it doesn’t matter too much if you buy into the narrative that this is where the internet was in the early 90s and this is the future...

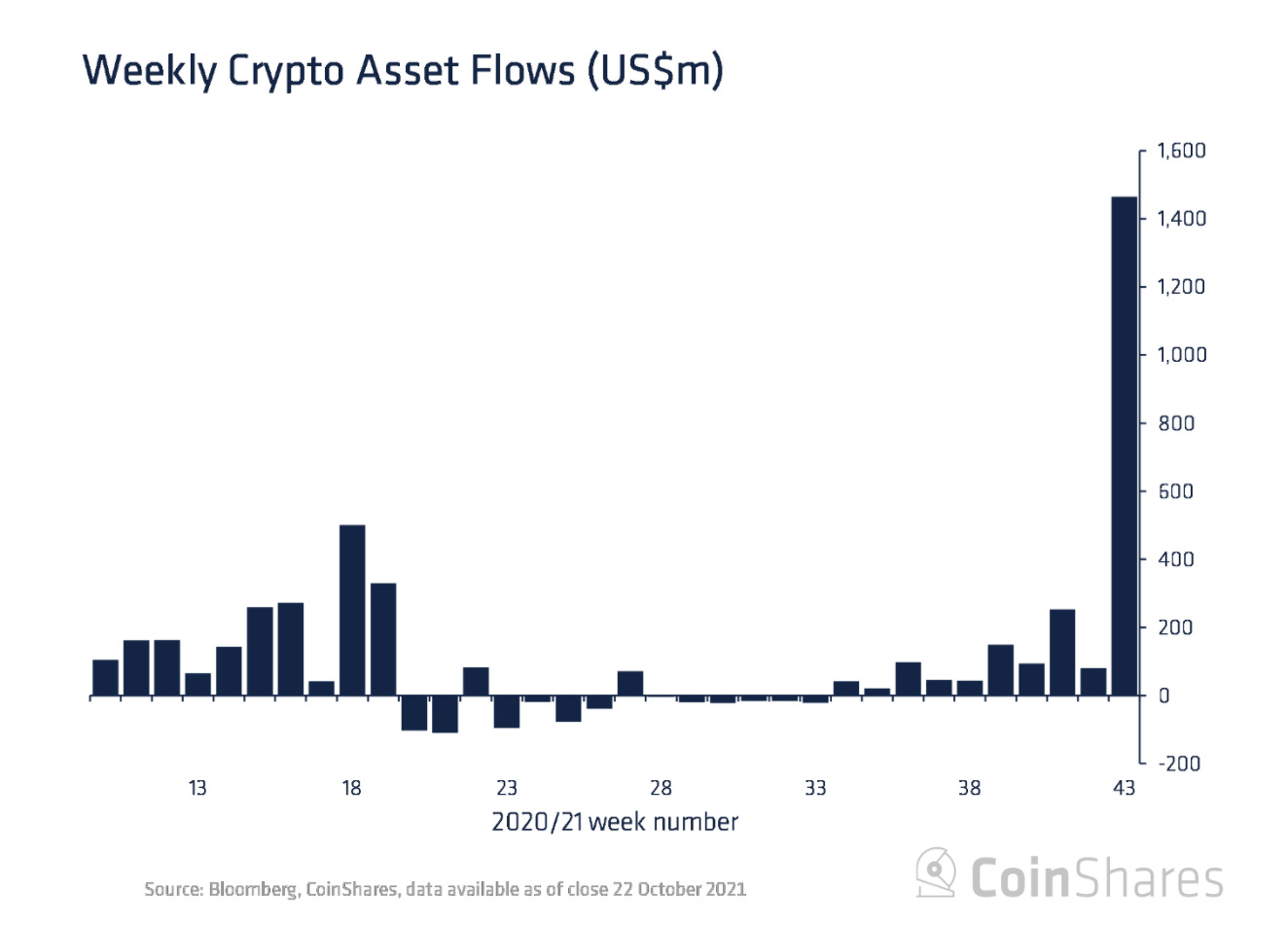

Aside: Pay attention to the weekly crypto-asset flows from Coinshares for an indication of what institutional/accredited investor flows are doing; last week these inflows hit a record $1.5bn after the launch of the $BITO [Bitcoin futures ETF]

Whatever your view, it’s worth getting a seat in the arena, joining a DAO, hopping in their Discord, watching out for scams [!], procuring some Ether [and other native L1 units] and stocking up on marshmallows - it’s going to be a wild riiiiiiide.

2. A ella le gusta la gasolina (Dame más gasolina)

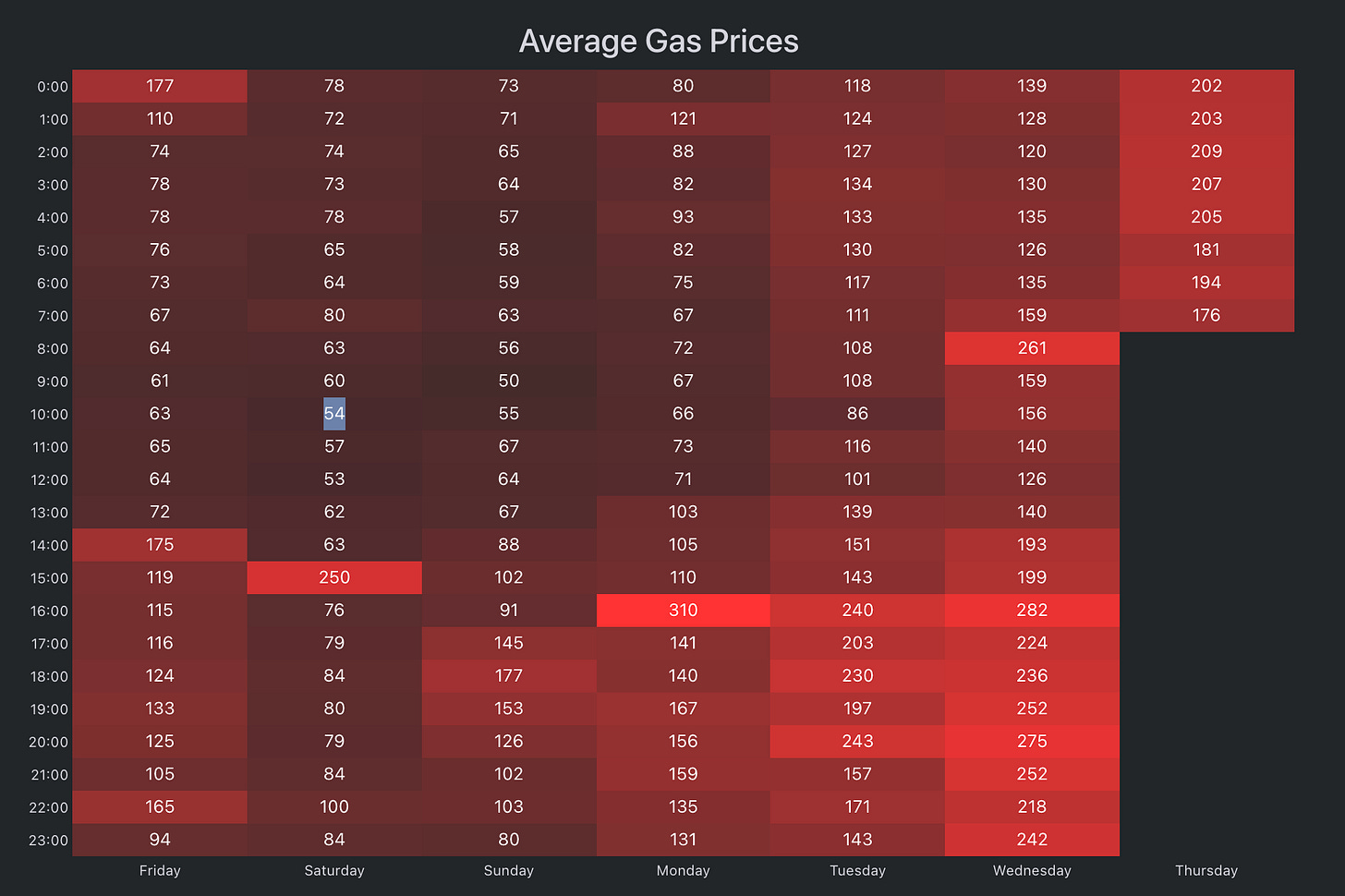

What do a meme token [with utility apparently] and Ethereum gas prices have in common? Well. This:

Notice how average gas prices started increasing Monday of this week…

And how that coincides with Shiba Inu 🐕 trade volume/price volatility. It’s an ERC-20 coin trading on the Ethereum chain and because of the massive volumes traded these past few days, it’s adding to transaction congestion on the Ethereum chain (a bit like the I-10 @ 4 pm or the London underground at 7:55 am).

The net result is: the price of gas paid with the native token, Ether, goes up. This is why ‘scaling’ [adding transaction processing capacity] is important and why people heatedly discuss different Layer 1 blockchains [i.e. base layers like Solana/Avalanche where settlement takes place], sidechains [Polygon etc.] and rollups [zks etc.] to solve the dilemma.

Gas costs are a point of contention, and while Ethereum transaction costs for transactions stay above 50-100-200+ Gwei, the incentive programs offered by alternative Layer 1 blockchains make more sense for NFT / DeFi projects building their dApps. This week, Near protocol launched an $800m grants program for DeFi projects, joining Harmony, Avalanche and Celo in the ‘plz build on my chain, bruh’ battle. It will be interesting to see how high [$$$] these reward programs will climb… Anticipating $1bn for the next announcement. Go big or go home.

Another interesting result of this is the ‘Crypto Jobs Boom’ and engineers/coders/developers/contributing DAO members are quickly becoming some of the most highly valued human capital in the world.

3. Trick or treat?

Whilst we are obviously enthusiastic about digital assets, there are some real risks [and vast opportunities] to beware [take advantage of]. Airdrops can be enticing, but always check the details of the transaction in your Web3 wallet in case it’s a bit nefarious. Coinbase put together a useful article on some good health and safety tips for users.

Whilst the recent DeFi report from Goldman Sachs met some light joshing within the CT community, some of their points are valid; DeFi 2.0 is exciting but is at risk from hacking, protocol bugs, de-leveraging etc.

As mentioned earlier, decentralized lending protocol, C.R.E.A.M. was just hacked *again* yesterday for $130+ million and they are somewhat of a stalwart in the stack.

Conclusion: the risks are there, relatively well-documented and the phrase ‘Do Your Own Research’ [DYOR] is everywhere. This is also why Institutional DeFi adoption is a somewhat slower process than the underlying digital asset adoption: institutions have to provide the right level of protection to their clients whilst conducting business.

However, institutional [Compliant] DeFi is now a growing market with Aave and Compound both venturing into the market with institution-grade DeFi products. The benefit of a KYC/AML layer in DeFi is that the counterparty-risk is lowered; being part of a known and trusted-counterparty environment is a lot safer for institutions to conduct decentralized financial transactions and one of the reasons why institution-grade DeFi technology providers like Alkemi Network are particularly well-positioned to meet demand as the SEC analyzes the ecosystem, the FDIC prepares guidance for banks and the FATF releases somewhat vague [Valkenburgh] crypto guidance…

And now for something staggering for the boomers amongst us: Finfluencers and TeenFi

Whilst some of the advice dished out by the youth can be illuminating, uncontrived, genuine, non-jaded, fresh, smart and plugged-in, there is also a lot to be said for experience. Experience is tricky to fit into a Tik-Tok video or even a textbook and while history does tend to rhyme, it doesn’t necessarily repeat. At least, not in the same way. The echo-chamber nature of Crypto-Twitter and FOMO can create some real wins but also some EPIC losses. Teens are taking over finance - “AND YOU ARE NOT READY FOR IT”.

… brought to you by Alkemi Network

Alkemi Network is building an on-chain liquidity network with a suite of tools and products that serve as onramps for everyone to participate in decentralized finance. Access subsidized borrowing rates on the Alkemi Earn platform, use the ‘Verified’ digital asset pool to conduct borrowing and lending within a trusted-counterparty liquidity environment. Be compliant, use Alkemi Network.

AMA incoming: