This could be a line from a conversation overheard in Brooklyn, Berlin or Sydney. This week was all about what’s sexy, trendy and trending, although arguably that is what it’s always about. From sexy DEXy traded volumes soaring this year [alongside DeFi TVL and crypto market cap both hitting ATHs], to the bright future for NFTs and the race to infinity and beyond for everything, at all times, it was a crucial up-week for digital assets and the burgeoning on-chain ecosystem. Let’s have a looksie!

1. Trendy DEXs

Do you remember your first on-ramp adventure into crypto? Many of us have, at some point, bought assets on a centralized exchange ‘CEX’. Maybe even Tim Cook [🍎] did when he bought crypto. Chances are, he would have gone through KYC and used a bank account to fund the transaction. A lot of newcomers to the now $3 trillion crypto ecosystem [7x YoY] will also use their bank accounts to buy these digital currencies.

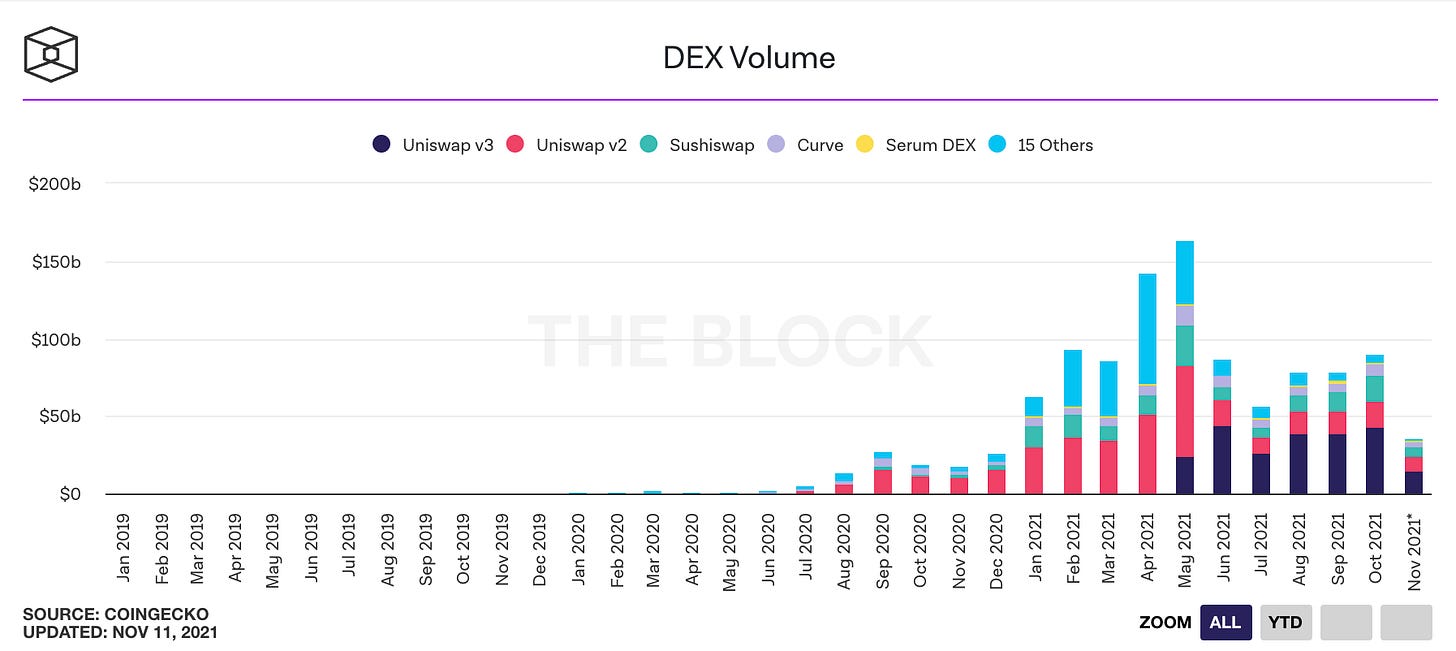

For large portions of the world, the decentralized way of thinking and doing things is becoming trendy. The idea of being part of a decentralized network where you can ‘do your thing’ and ‘retain your data’ [without giving it to centralized corporations], has been gaining traction after countless breaches. Decentralization is one of the core principles and mechanisms of crypto. So, with the many project tokens having now launched into the ecosystem, it makes sense to have decentralized exchanges ‘DEXs’ to swap them. In the past few years, DEXs [like Uniswap and Curve] have appeared, running on blockchains [like Ethereum], gaining user traction and capturing significant crypto-to-crypto transaction value. It is interesting to see these DEX traded volumes have recently been soaring - up 550% so far this year.

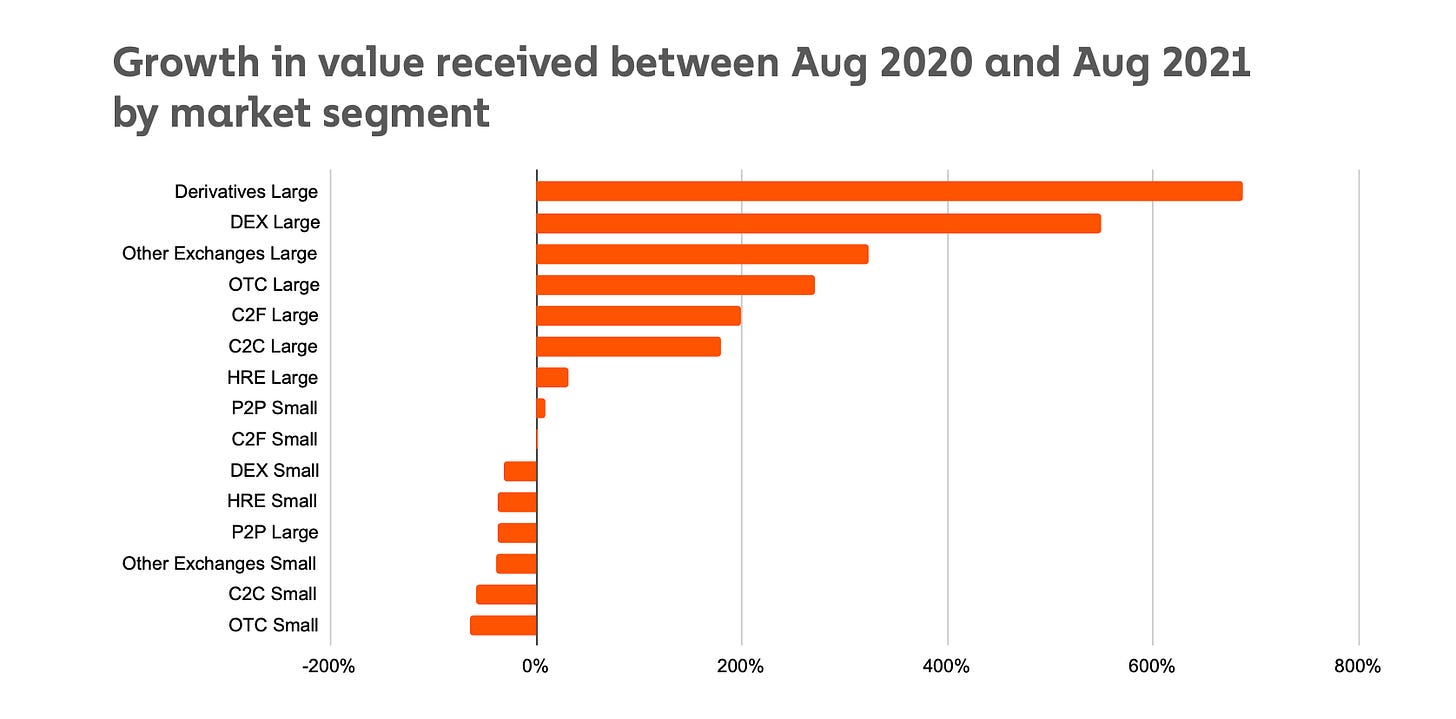

Have a look at the Chainalysis' full report to see that it’s actually derivative exchanges that are topping the bill.

Whilst the mainstream hasn’t joined the automated market maker [AMM] movement yet [DEXs make up a relatively small portion of the traded value in comparison to their centralized counterparts [approx 8-10%, according to The Block], it’s still interesting to see such large values exploding into existence out of… well, the Ether.

Most of us will need fiat [USD, EUR etc] for a while yet, so expect centralized exchanges to retain their dominance for now [see CEX Binance 24hr volume sits at $47 billion today, ~5x more than CEX Coinbase, ~10x more than DEX Uniswap V3]. Even Revolut is trying to get in on the action… However, the ease of launching markets for new tokens is a DEX *USP* and perhaps once the majority has migrated on-chain, once the digital asset ecosystem has reached $10 trillion [vs global equity markets @ $105 trillion] we might see the flippening of DEX v CEX volumes!

2. Need relevance? Launch NFT

First things first, giving it up for Rolling Stone who are navigating their way through relevance by continuing to be rock ‘n’ roll in a whole new way. Great article!

Getting on board the zeitgeist train is crucial for companies trying to retain their presence in today’s shifting market. BAYC launched with no money, to little ceremony; struggling to sell - even at 0.08 ETH apiece. Want to see the floor price now? 32.8 ETH = $155k. LOL. [Note: 10x of that $ amount is the ETH price appreciation YoY tho].

Also, re relevance: did you get a McRib NFT? As Allison Morrow points out in her article, a moment of mindful reflection, the lunacy of this trendy/trending space is real … but then, this is a topsy-turvy Metaworld, where trends go viral overnight, where creative destruction motors on, where the nimblest survive [via WAGMI] and Crypto Twitter go on wild tirades about it all even when they’re making ‘bank’. The balance is perhaps keeping one foot on the ground both in and out of Decentraland.

However, it is advisable not to step out completely, because as was discussed this weekend at NFT LDN - to a crowd that wouldn’t have known to gather a year ago:

“NFTs aren’t just JPEGs and they are going to be part of the crypto conversation for a long while”.

The possibilities for NFTs are limitless. They could represent land ownership or keys to unlock a vault; any real-world asset has the potential to eventually be represented on-chain and custodied by its rights-holder. In the immediate future, the outlook for blockchain gaming NFTs is particularly exciting: Metaverse marketplaces where individually-designed buildings or furniture pieces are available for purchase to put into the virtual rooms of VR games, wearables designed by Dolce & Gabbana can be worn by avatars for an extra level of ‘flex’… it’s all possible and becoming a reality.

For more interesting insights, have a read of Jamie Burke’s paper on the Metaverse and if you’re looking to get started in NFTs, have a read of the Harvard Business Review article on ‘the why’ and then Bankless’s Medium post about ‘the how’.

3. Flexing [your City Coin]

New York is getting its very own ‘NYCCoin’, just as Miami did back in August. Unaffiliated with the government but linked to the NY Mayor-elect Eric Adams’ pro-crypto stance [first three Mayoral paychecks in Bitcoin, pls] the coin can be “mined or bought by anyone who wants to support New York City while earning crypto via the Stacks protocol”. Note: Stacks is effectively DeFi on BTC.

How much of this is a publicity stunt to garner press & stay relevant vs Eric’s desire to actually get paid in $BTC and [unknowingly] participate in an NYCCoin scheme to earn revenue for NY is yet to be seen, but either way, it just about satisfies the ‘flex’ criteria. The question is, will NYCCoin require greenlisting and will Eric try to address the Bitlicense?

‘Flexing’ is becoming part of the modern vernacular but is deep-rooted in ancient history; Egyptian necklaces, use of tombs, hieroglyphs, all aspirational, all flex goods. Like modern-day… Birkins. The grassroots of establishing the luxury goods market today. A status symbol representing aspirational membership, flex goods have asserted themselves in crypto and NFTs in particular… Being a member of the BAYC with an ape badge is a solid flex; IYKYK. An .eth address is another sort of flex, at least for the Ethereum community and if you held one ahead of the snapshot you probably received an airdrop, which was like an affirmation for the flex, similar to the airdrop of $AGLD for Loot holders. That’s like getting $LAMBO tokens for owning a Murciélago.

Moral: Get your flex on. Get a BAYC NFT. Get NYCCoin. Go to Miami. Flex hard. Come back to NYC. Be compliant with the Bitlicense though.

And now for some Centralized color from Decentralized minds:

Gotta appreciate Michael Saylor’s unerring bullishness. As SBF of FTX remarked yesterday on his ‘DeFi-ING EXPECTATIONS’ webinar panel, “crypto accounts for less than 1% of the market by capital allocated.. yet there's a 50% chance that when you turn on CNBC they're discussing crypto”. Well, here’s Bloomberg also pushing the odds with a set of heavy hitters. Mainstream? Open to interpretation!

… brought to you by Alkemi Network

Alkemi Network is building an on-chain liquidity network with a suite of tools and products that serve as onramps for everyone to participate in decentralized finance. Access subsidized borrowing rates on the Alkemi Earn platform, use the ‘Verified’ digital asset pool to conduct borrowing and lending within a trusted-counterparty liquidity environment. Be compliant, use Alkemi Network.

Let us ‘flex’ a bit too: